Washington State Considering Tax On Any WiFi Device

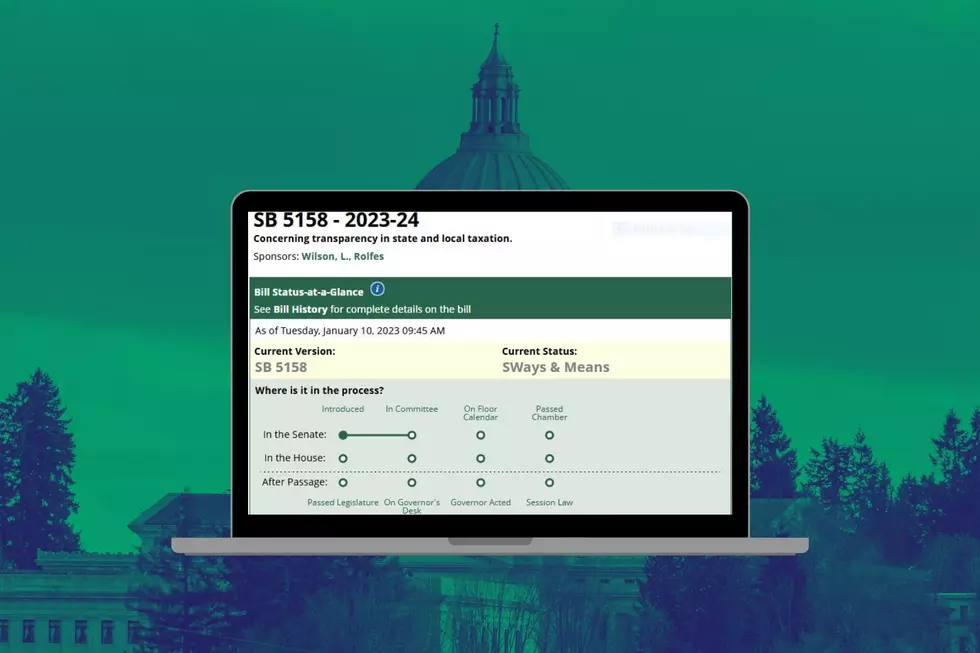

A bill under consideration in the Washington State Legislature targets any device that can access the internet for a new fee to be charged at the time of purchase according to The Center Square. The House Finance Committee held a hearing in Olympia and received pushback from groups opposed to a new tax and support by organizations favoring the legislation's intent at bridging the digital divide.

The “digital divide” is a term used to describe disparities in access to the internet and download speeds.

Cellular Telephone Industries Association says over 30% of your wireless bill includes taxes and fees, second-highest in the U.S. HB1793 would add $2 on the purchase of smart devices priced above $250.

The proposed bill has defined smart devices as those “capable of wireless access to the internet. This includes, but is not limited to, smart phones, laptop computers, tablets, wearable devices, smart speakers, gaming consoles, smart gyms, and smart televisions" according to a report in The Center Square.

The rub; what is a smart device and what devices might be subject to the fee if the legislation became law? The Washington Policy Center is concerned many other home consumer items could also be subject to the tax including some medical devices, automobiles, security cameras and alarm systems, household appliances, hot tubs, dog collars, and septic tank water alarms.

Business and trade groups are concerned about the impacts to the thousands of businesses that could be subject to collecting the tax. Objections ranged from the expense of tax reporting software upgrades to concerns the tax actually raises the cost of accessing the internet, the opposite of the bill's intent.

The most pointed objection came from the taxpayers watchdog group Washington Citizens Against Unfair Taxes. Jeff Pack asked the committee "when is enough with all these taxes and fees? You’ve gone after income, property, more excise taxes, higher fees, all for whatever your latest agenda is.”

HB1793 could raise an estimated $100 million by 2029

Emily Grossman, managing director of the Digital Inclusion Unit of the state Department of Commerce noted the new tax is not in Governor Inslee's budget proposal but represents a new permanent revenue stream for digital equity in Washington state.

All the Outdated Technology From the First ‘Mission: Impossible’

More From Washington State News